What is a good net profit margin for your business in Australia is one of the best questions to ask as a small business owner because the net profit margin hugely affects the cash levels in your business bank account and the stress levels you’ll feel from your business.

Working with hundreds of medium and small businesses in Australia and seeing their Profit and Loss Statements for 3 year periods has led to some interesting insights about what is a good net profit margin, and the facts are quite different to what the opinions are on this subject.

The net profit margin directly affects the cash in the bank so if it’s too low there can be regularly cash shortages and with that – stress for you. Work on increasing the net profit margin in businesses has shown the remarkable difference it makes and it’s become the primary focus of our business mentoring services.

Before answering what is a good net profit margin, another question needs to be asked – is it the gross, net or operating profit margin that’s important to focus on?

Which one is the best measure of a “good profit margin?”

Profit margins are far more important than gross or net profit to understand because the margin is the percentage of profit.

The percentage reveals the relationship between two essential figures – sales income and profit.

That’s important because when revenue of a business doubles, ideally so would the gross and net profit, so all three of these dollar figures change with growth over time.

However, the gross and net profit margins could stay the same, which makes them more important to watch over months as your business grows.

The 3 Different Profit Margins

In any service business, there is at least one Cost of Sale – i.e. the technical/hands-on employees’ labour time/cost.

Without the service businesses technical employees, the work from the sale can’t be carried out, so they are best to be considered a Cost of Sale (and be shown as such on the Chart of Accounts and Profit and Loss Statements).

Unfortunately, a lot of companies don’t have their employee labour allocated to being Costs of Sale, which makes the Gross Profit and Gross Margin figures far less relevant and important.

The Gross Margin on income (with technical employees considered a Cost of Sale) is a very important figure to know in a service and manufacturing business.

The gross profit of a business has to cover expenses, to make a net profit, so the aim is to increase the GP and Gross Margin in order to have a higher net profit.

The two other types of profit and margins are…

- Operating Profit Margin

- Net Profit Margin

This is where a lot of businesses in the change over to Xero haven’t quite had their Chart of Accounts set up ideally.

A well set up Profit & Loss Statement will resemble this…

| Total Income - Revenue | $1,000,000 |

| Cost of Sales | |

| Materials | $150,000 |

| Subcontractors | $50,000 |

| Employees (technical) | $200,000 |

| Total Cost of Sales | $400,000 |

| Gross Profit | $600,000 |

| Total Expenses | $500,000 |

| Operating Profit | $100,000 |

| Other Income | |

| Interest on loans | $2,000 |

| Income from grants | $10,000 |

| Other Expenses | |

| Net Profit | $112,000 |

Other Income is ideally listed after Operating Expenses because Other Income is non-trading or Operating Income. It’s the same with Other Expenses showing after Operating Expenses.

Operating Profit is profit before Other Income and Other Expenses. Net Profit is then calculated after these two.

Other Expenses are ones not related to ‘normal’ operation of the business.

This whole subject can become very technical, very quickly, but the above table is a good model to better understand your business.

Operating Profit Versus Net Profit

The above table shows both, but one comes before the other.

Operating Profit and Operating Profit Margin are both calculated before Other Income and Other Expenses.

The figures when expressed as a percentage of profit on revenue often vary very little, in the order of 1% to 2%, so we can consider them to be close enough to be the same figure for most businesses, especially when annual revenue starts to exceed $2,000,000.

With all this information addressed, the original question can now be addressed…

So What is a Good Profit Margin?

There’s no “recommended” figure for Gross Margin for all businesses, let alone all service or all manufacturing businesses due to major variables of what is Costs of Sales across industries.

That’s due to the fact that some businesses may have up to 4 or more Cost of Sale types, such as employees, materials, products, subcontractors and even rent of equipment.

Due to all these variables, you need to consider what a good Gross Margin is for your own industry.

Keep in mind that most “benchmark” data does not consider technical/hands-on employee labour as a Cost of Sale, so the Cost of Sales percentage, gross profit and gross margin figures won’t tell the true or full picture unless you add in the labour cost as well.

This page on the ATO government website has a list of industry types you can look through to find benchmark figures for your own industry.

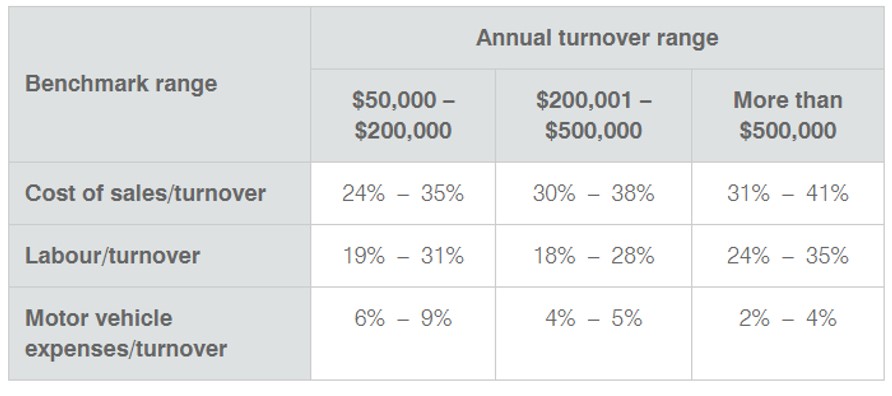

Here’s an example screen shot of a benchmark page for electrical contractors operating in Australia showing the Cost of Sales as a percentage of revenue…

The Cost of Sales shown would just be for materials only.

Looking at the higher range of figures for the $500,000 revenue, the Cost of Sales is 41% at the highest and employee labour is 35% to give a total Cost of Sales of 76%. That would make the Gross Profit Margin 24%.

The figures are definitely on the high side, but considering the figures are taken from real businesses, they are actual figures.

When the gross margin is 24% and expenses still have to come out of that, it means the operating and net profit margin will be quite low.

When it comes to understanding ‘what is a good profit margin’ – the question is most relevant to the Operating or Net Profit Margin figure as the Gross is a big variable from industry to industry.

What is a Good Operating or Net Profit Margin?

Let’s assume these figures are close enough to be the same and discuss Net Profit Margin or “Net Margin”.

There are figures that the “business world” will throw around, based on what’s being achieved, and then there are the figures to strive for that can be achieved.

After 15+ years of looking at hundreds of Profit and Loss Statements to see actual Net Margins, plus discussions about Net Margins with dozens of accountants, who see the figures, the reality is that…

90% of service businesses, over $700,000 revenue, operate with less than a 10% Net Profit Margin

These businesses are regularly struggling with low cash reserves and if that keeps if, they often fail.

The reason they fail is debtors keep increasing to the point of no return and they simply run out of cash.

Ever heard of a cashed up business failing?

Often the fault is said to be “poor cash flow” when in fact, in the majority of cases the fault is the business operating with a low Net Profit Margin.

When the Net Margin is low, it directly reduces how much cash stays in the bank after every sale.

Every sale obviously contributes to the Costs of Sales and the Expenses are necessary to run the business, so every expense also can be associated with every sale.

When the income goes into the bank from a single sale, what effectively comes out is the Cost of Sale for the job, plus the proportion of expenses.

This is best explained with a table, showing two different businesses, with the same revenue but with different Net Margins…

| Total Income | $700,000 | $700,000 |

|---|---|---|

| Net Profit | $140,000 | $70,000 |

| Net Profit Margin | 5% | 20% |

| Sale Value | $1,000 | $1,000 |

| Cash left in Bank after COS & Expenses | $50 | $200 |

In the above table, it shows what happens when a $1,000 sale is made and the money is banked. After the money is received the relevant Costs of the Sale and the Expenses, proportional to the sale value, needs to come out as well.

The amount coming out of the sale is indicated by the Net Margin.

When a business has a Net Margin of 20%, it means the costs and expenses are 80% of income (if every cost and expense is proportioned into every sale).

In the case above, when the Net Margin is 5% then 95% of the costs and expenses are paid out of the money received.

Can you see how cash flow is greatly influenced by the Net Margin?

The higher it is, all things being the same, the higher the amount of cash in the bank the business will have.

Because of this, there is a figure that through the experience of mentoring business owners for decades, and seeing how much cash they had in the bank (a very common discussion point and solution many business owners wanted), a Net Margin figure was identified as being the ideal minimum…

An Ideal Goal for the Net Profit Margin figure is 15%

That’s a good target, at least for 90% of businesses. Some industries such as retail and professional services need to aim for higher targets.

Unfortunately, after looking at hundreds of business’ P & L Statements over a 3 year time-frame, it was found that 90% of (established businesses – with revenues over $800,000) are operating with less 10%.

Just because its a common figure doesn’t mean you should settle for it!

So why 15% as an ideal goal?

Over months of training and tracking cash flow, it’s been seen that when a business reaches that figure, the business starts to have enough cash to meet its financial obligations and can pay all its invoices on time and still have surplus cash that increases.

It obviously varies from industry to industry as payment terms STRONGLY dictate available cash in the bank. For businesses being paid on average 30 days or more for a sale, then a higher figure than 15% will almost certainly be needed to stay “solvent”.

The higher the Net Margin figure, the better!

Want to Learn 5 Ways to Increase Your Business’ Net Profit Margin?

Book in for a 15 minute ‘EXPLORE Call’

I’ll identify 5 strategies for your business in 15 minutes – and make sure you understand them.

15% is low for some industries and for some the goal needs to be 20% or 25% or even higher. These figures have been obtained with many clients so they are achievable.

Every business benefits from a constantly increasing level of cash in the bank, however, that is extremely uncommon, at least for the 90% of businesses operating with less than 10% net profit margin.

That leads to the next important question…

What Net Profit Margin Figure is Possible?

90% of traditional businesses don’t go beyond 10% Net Margin – when revenue exceeds $700,000.

Why is the $700,000 figure relevant?

That’s when most overheads have kicked in and the business is established.

At $700,000 these are usually seen as part of the business…

- A premises is rented the business operates from

- An admin person to answer phones and do basic office work has been hired

- Work vehicles have been purchased

- Equipment has been and is still being purchased

Below $500,000 revenue a business often operates with 25% Net Margins or higher, because they don’t have some or all of those expenses being paid for.

At $200,000 revenue it’s not uncommon for some businesses to have a 50% Net Margin as there are few expenses and the business owner is working hard, often on their own.

Above $700,000 revenue is where the Net Margin also becomes super important to focus on.

This is entering the “management” phase of your business and where managing it and not doing the hands-on income-producing work becomes very important.

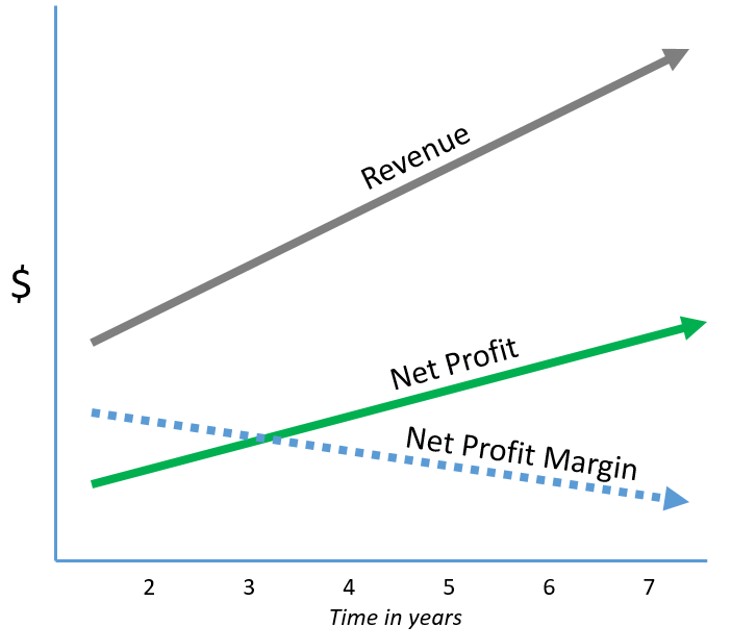

Why? Because of what this graph shows in regards to Net Margins as the Revenue increases…

Even though Revenue and Net Profit dollar figures both increase each year, the Net Margin can be decreasing by a couple of percent each year.

This small, negative creep is rarely seen or picked up – even by accountants, so business owners don’t notice its happening.

What it means in real-life terms is that the cash reserves are decreasing.

This whole topic of gross and net profit margins, plus more importantly, how to increase both is the aim of the Business Freedom Mentoring where clients’ results are outstanding.

There are two main stages of growing a business, which are…

- Stage 1 – start-up to 2 or 3 employees

- Stage 2 – 3 employees and above

If your business is in Stage 1, your focus needs to be on generating and increasing sales, to hire more income producers to increase revenue.

Learning about marketing is highly beneficial, not just paying for a business to do it for you. It’s even better to pay a marketing mentor to educate you on top quality marketing so you understand what you’re paying for.

90% of all marketing is poorly executed, so leads can be hard to obtain despite the business paying for outside suppliers – such as a new website, SEO, Google Ads, and Google Map listings.

Training isn’t expensive, but ignorance is. The cost for education, that is used for your whole life in business is low compared to the ignorance cost of tens or hundreds of thousands of wasted money on websites, social media and PPC.

If your business is at Stage 2, then “management” is a priority with your time, where you “optimize” and streamline your business with software, KPIs and employee time tracking is important, to increase efficiencies and the net profit margin, to have more cash to reinvest in growth through marketing etc.

Optimizing can be applied in all areas, for example, how you/your team answers the phone. How your team talks to prospects greatly affect your conversion rate from leads to sales, plus your ability to win sales at higher prices than competitors.

Being the cheapest for prices as a way to win sales is a race to the bottom and usually leads to business failure.

Being able to convert leads into sales with selling skills, at higher prices than competitors is one big opportunity for businesses and is achievable for the majority too, if the business invests in sales training for answering phones and quoting.

Looking at what to measure and how to measure is essential to increase Net Profit Margins, in fact, it is THE most important ingredient of achieving higher Net Margins.

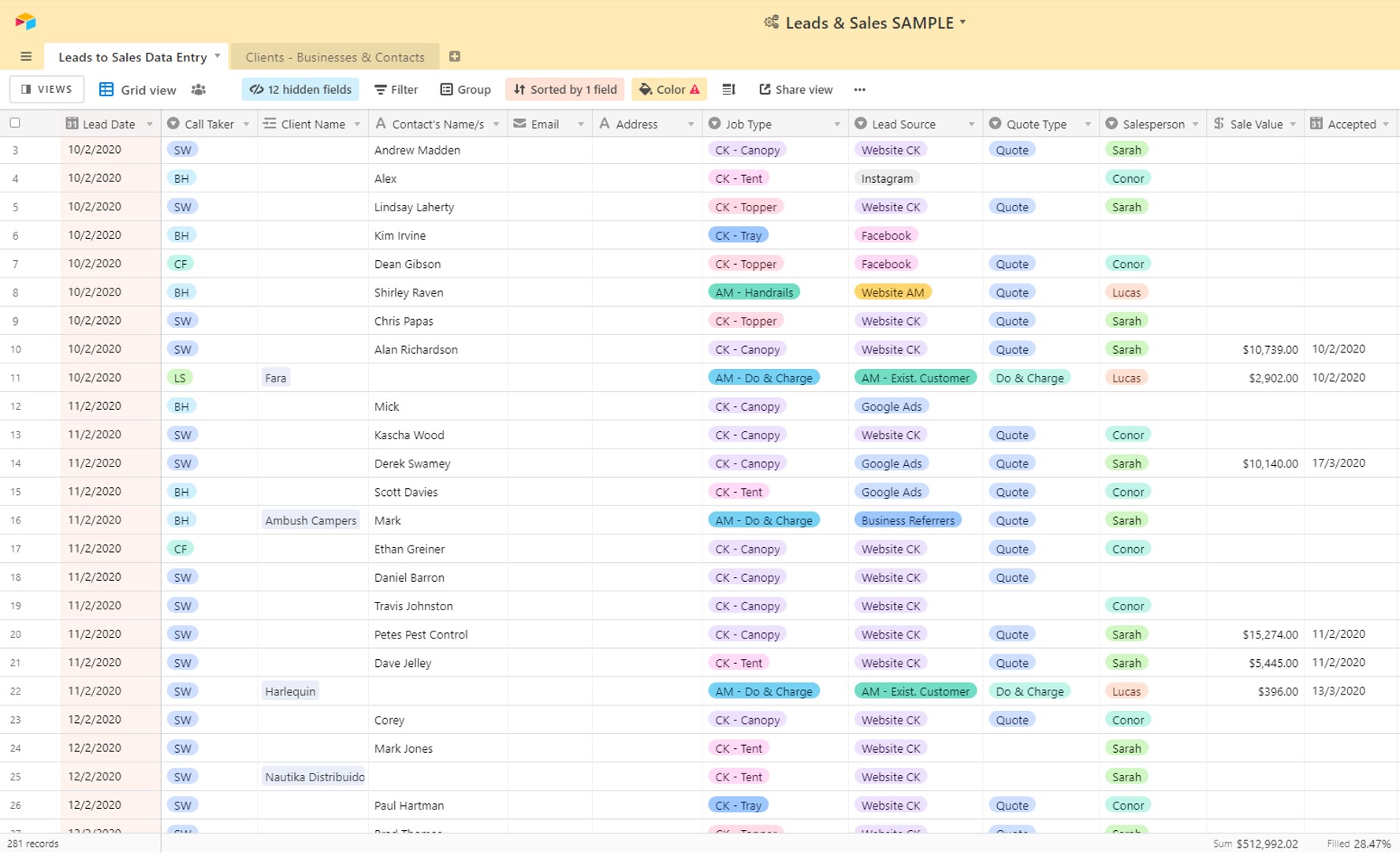

A free measuring tool for tracking Leads to Sales by lead sources and job types, showing all conversion rates is now available to you. In the screenshot below you can see what it looks like.

It was created as a template for any service or manufacturing business in Airtable, an online Excel related tool but on steroids.

It can also be used to track all jobs, such as work in progress percentage status, gross margins on jobs and even gross margins of each employee on jobs. All this is built into a template that clients of Profit Transformations mentoring service receive. The template is then the basis of building a fully customised version to exactly suit the business’ needs.

Here’s a screenshot of what it a free to use Airtable template looks like…

Business Case Studies of Net Profit Margin Increases

When it comes to what’s possible with Net Profit Margins, take a look at these client results…

Milton, who was stressed and working hard in his plumbing company. He saw these results in 4 months…

| Before business mentoring | 6 months of business mentoring |

|---|---|

| Revenue per year $750,000 | Revenue per year $998,000 |

| Net Profit per Year $22,500 | Net Profit per Year $209,000 |

Alan – a powder coating manufacturing business owner saw these results during a 4 year span…

| Before business mentoring | From 7 months of business mentoring |

|---|---|

| Revenue per year $450,000 | Revenue per year $1.8 Million |

| Net Profit Margin 15% | Net Profit Margin 'Over 35%' |

| Hours work per Week 60 | Hours worked per Week optional |

Here’s Chris an electrical contractor’s before and after results, in one financial year…

| Before the Academy | After the Academy |

|---|---|

| Revenue per year $1.5 Million and stagnant | Revenue per year $2.3 Million |

| Net Profit Margin 15% (best) | Net Profit Margin 25% |

| Hours worked per Week 55 | Hours worked per Week 32 (when no on holidays) |

Jo and Brad who owns a software development company. Their company Net Margin made a big jump in the financial year…

| Before business mentoring | After 8 months of mentoring |

|---|---|

| Revenue around $2 Million | Revenue around $2 Million |

| Net Profit Margin 1% | Net Profit Margin 16.5% |

Watch the short videos of business case studies where the owners share their experience nad results of increasing their net profit margins.

While higher revenues are worthwhile, its the Net Profit Margin that really determines the asset value of an established business.

A Net Margin of zero means no profit, so the revenue could be $10 Million but what commercial, saleable value does the business have if the net profit is zero?

Increasing Net Margins requires very different thinking as its about improving tasks the business already carries out.

It’s about team building, systems, KPIs and measuring to find facts, so that your business decisions are made with certainty, employees perform because they have to as they can’t argue with their own KPIs.

Increasing Net Margins changes the whole relationship you have with your business. It can literally be a profit transformation!

Higher Net Margins create the surplus cash you can use to pay for an extra employee, to completely free up days of your time to work on your business or to take more holidays.

Discover 7 Ways to Increase Your Business Profits & Margins

If you’d like to learn more about net profit margins and increase profit, plus how to leverage your effort so you achieve more while working less you’re welcome to grab the complimentary book 7 Ways to Improve Your Business in 5 Days.

The book explains how to increase operating profit margins through business optimisation that can lead to the ultimate goal in business “business freedom” – achieved with a 7 ingredient formula also provided in the book.

Increasing your business’ net profit and margin is actually quite easy after 20+ years of focus on this one area. If you would like to learn about some of the most powerful strategies you are welcome to register for a Profit Potential Meeting where you wil discover an expert’s way to increase the net profit margin in your business.

You’ve got nothing to lose from having the consultation or by download this book – but there’s much for you to gain in your business and your quality of life!

![What is a Good Net Profit Margin? [In Australia]](https://www.profittrans4mations.com.au/wp-content/uploads/Woman-coffee-desktop-reading-lg.jpg)